Using a Calendar for Personal Finance: Why it's Better Than a Simple List

Managing personal finances can be a daunting and tedious process, but it's necessary to have an understanding of how you spend your money and how to improve it. In this post, we'll explore why using a calendar for personal finance can be more effective than a simple list.

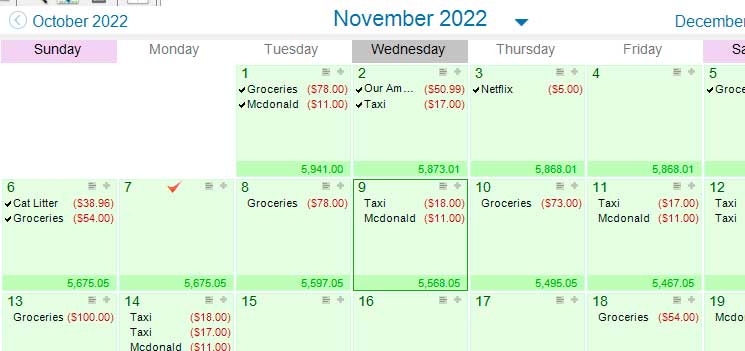

Visualizing Expenses

A calendar allows you to visualize your expenses by day, week, and month, making them more understandable and easily manageable. In a simple list, you'll have to figure out how to allocate your expenses and how to track them yourself.

Budget Planning

A calendar makes it easy to plan your budget for a certain period of time, such as a month or quarter. You can set how much money you want to spend on each day or week and track your progress using the calendar. In a simple list, it'll be harder to track how your expenses are distributed over time and plan your budget.

Payment Reminders

A calendar lets you set reminders for payments, such as electricity bills or rent, which will help you avoid late fees and penalties. In a simple list, you might forget about bills or not notice that they're overdue, which will lead to additional expenses.

Using a calendar for personal finance is a more effective tool than a simple list because it allows you to visualize expenses, plan your budget, and set payment reminders. If you want to manage your money better and avoid unnecessary expenses, using a calendar for personal finance can be an excellent solution.

Money Calendar

Money Calendar app offers all the features and benefits discussed in this article and more, making it a great tool for personal finance management. With the app, you can easily visualize your expenses, plan your budget, and set up payment reminders, all in one place. Try the demo version for free today and see how Money Calendar can help you better manage your finances!